Retirement Plans

Alpha Capital Management Group utilizes our experience and industry insight to tailor retirement plans to our clients’ specific needs. We help you with fiduciary guidance, plan design, employee education, regulatory changes and administrative support. Our mission is to provide every participant with the tools they need to achieve their financial goals. We believe being available to every participant individually is essential to making your company’s retirement plan successful.

Compare your plan’s expenses to industry norms through a full comprehensive analysis. Provide an easy-to-understand analysis of the health & performance of your 401k plan.

Benchmarking leads to more cost-effective plans, increased participation rates, higher employee satisfaction and better outcomes for your employees’ retirement

Breakdown of Average Plan Cost Per Participant by Provider

Total Plan Cost as a Percentage of Assets

Range of Investment Costs

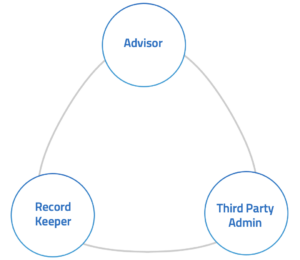

Conduct Comprehensive Evaluation of All Current Providers

Record Keeper

Third Party Administrator

Advisor

Fee Negotiation with Current Providers

If Necessary, Conduct Formal RFP Process to Select New High Value Provider(s)

Investment Due Diligence

Fiduciary Monitoring Reports

12-point Evaluation Criteria

Performance Reporting

Investment Share Class Review

Qualified Default Investment Alternative Selection (QDIA)

Design Optimal Investment Lineup

Mix of Active & Passive Funds

Fee Negotiation

Custom Asset Allocation Models

Is your current 401(k) Advisor available to meet with every participant? We are!

Hands-on advisor team available to help plan participants make the most of their retirement plans

On-going participant education meetings (English & Spanish)

On-site Enrollment Meetings (English & Spanish)

Assistance with rollover processing, loans and distributions

Individualized investment advice

Quarterly participant statements

Customized Education Program

Educational Seminars

Educational Flyers

Educational Videos

Quarterly Newsletters

Quarterly Asset Allocation Guides

Investments

Quarterly Investment Review

Fiduciary Monitoring Reports

12-point Evaluation Criteria

Performance Reporting

Investment Policy Statement Assistance & Monitoring

Investment Research & Selection

Fund Change Assistance with Provider

Fees

Continuous Benchmarking

Record Keeping

Third Party Administrator

Advisor

Fund Line-up Optimization

Plan

Quarterly Plan Review

Participation rates

Contributions rates

Investment Allocation

Distributions & Loans

Meeting Minutes & Documentation